Valuemetrix: Institutional-Grade Analytics for Retail.

Democratizing Wall Street-grade research. We verified that retail investors could handle institutional data density.

The Challenge

Retail investment tools are usually pretty toys. Valuemetrix is a weapon. We set out to build a platform that gives individual investors the same real-time data density and AI synthesis that hedge funds pay millions for.

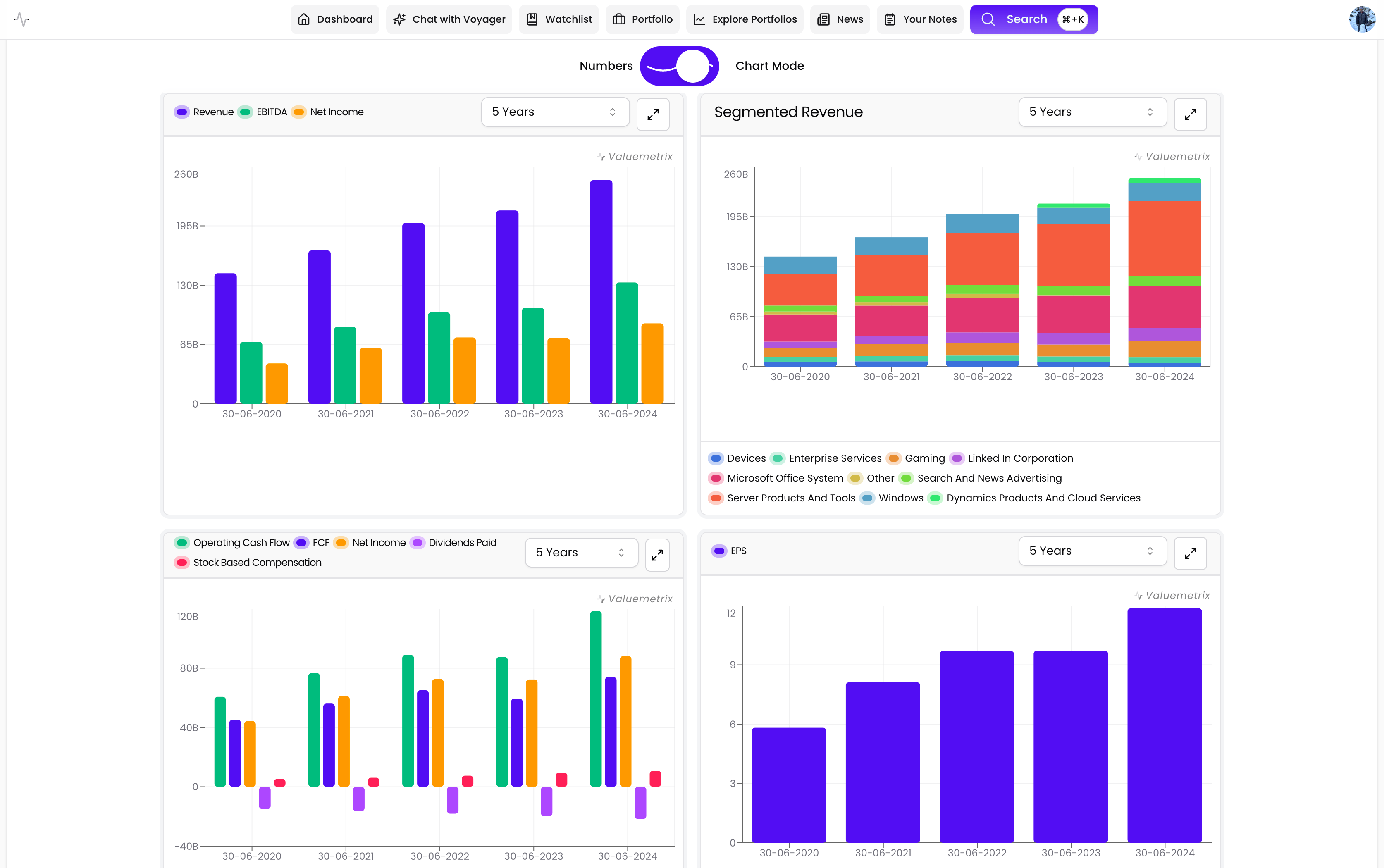

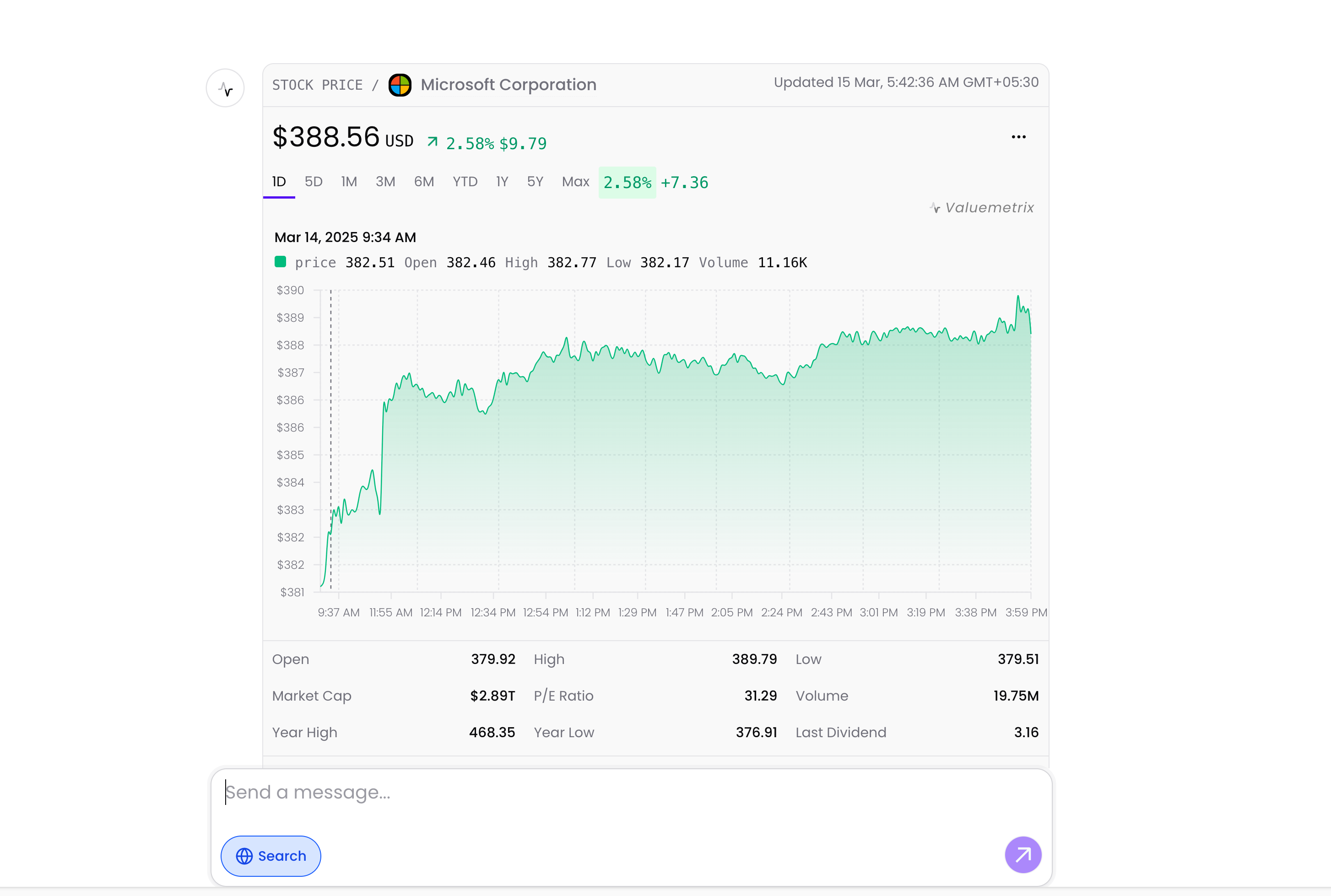

This wasn't just about showing charts; it was about processing massive streams of market data and synthesizing them into actionable 'Buy/Sell' narratives using LLMs. Pixelwand architected the entire data pipeline and frontend visualization layer.

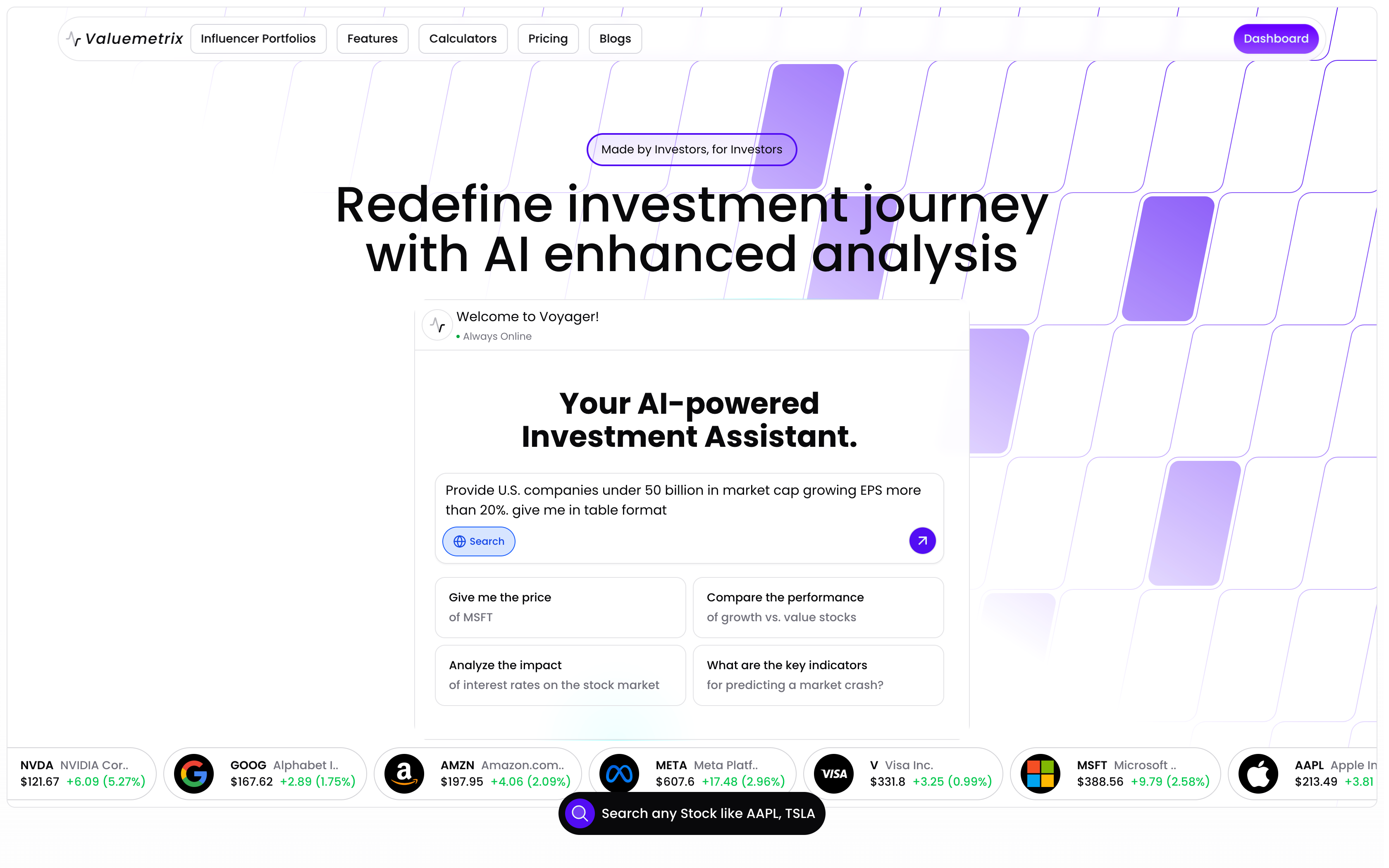

Visual Journey

Snapshots of the interface and user experience.

The Solution

Built a custom RAG (Retrieval-Augmented Generation) pipeline that ingests live SEC filings and earnings calls to generate instant investment memorandums.

Developed a proprietary caching layer using Redis to serve heavy financial queries in <200ms.

Integrated with 32+ brokerage APIs for direct trade execution, removing the friction between analysis and action.

Impact Delivered

Achieved 1,000+ weekly active users within 3 months.

4-minute average session time (3x industry average).

Acquired due to the proprietary value of the AI research engine.

Future Roadmap

Q3 2026: Mobile-first native app (iOS/Android) for trading on the go.

Q4 2026: Social sentiment analysis integration (Reddit/Twitter firehose).

Project Q&A

How does the AI engine work?

It's not just a wrapper. We ingest raw financial data (10-Ks, Earnings Calls) and vector-embed them. When you ask a question, we retrieve the exact context before generating an answer, ensuring high accuracy.

Is this secure?

Yes. We use bank-grade encryption (AES-256) for all data at rest and in transit. We never store brokerage credentials directly.