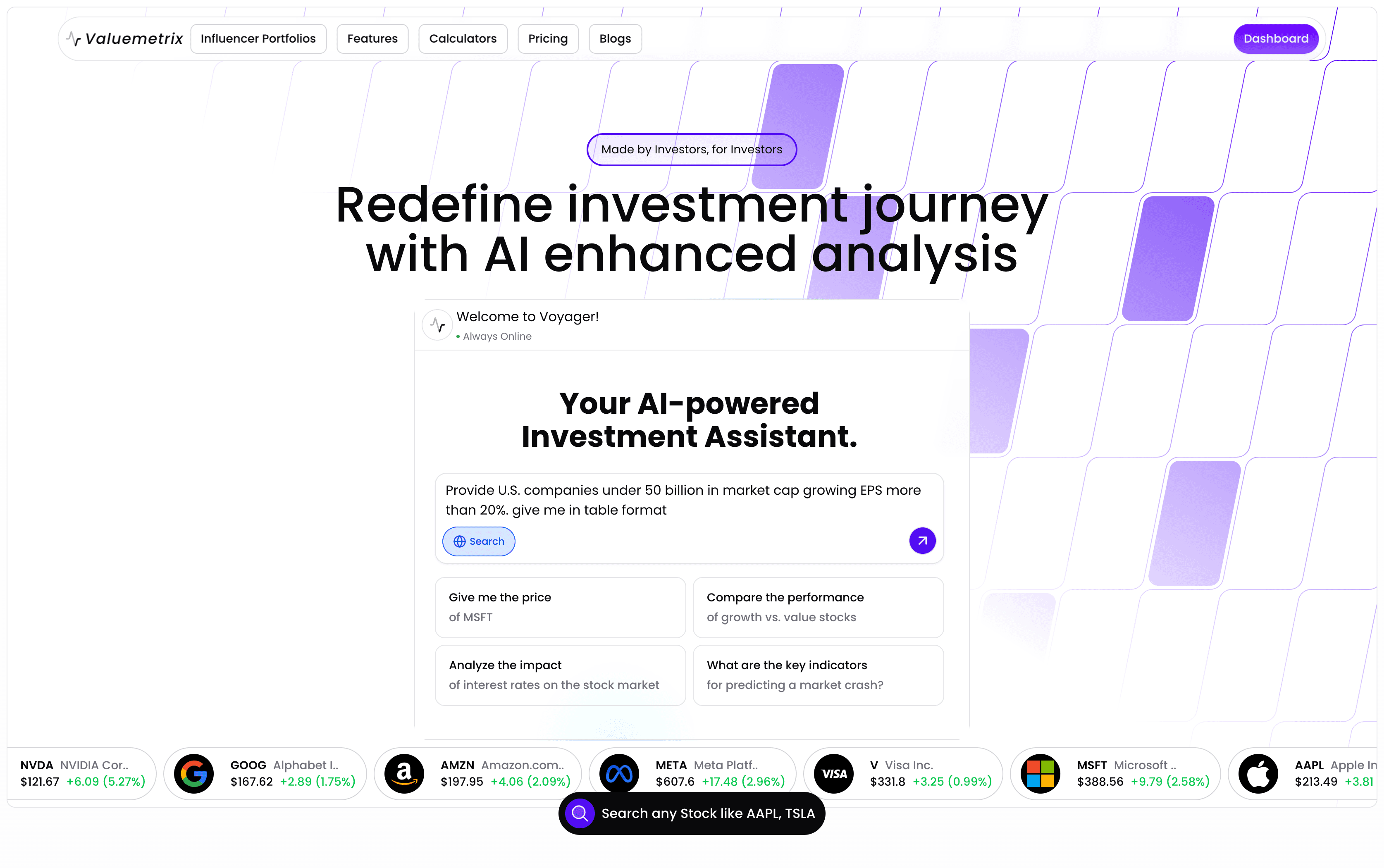

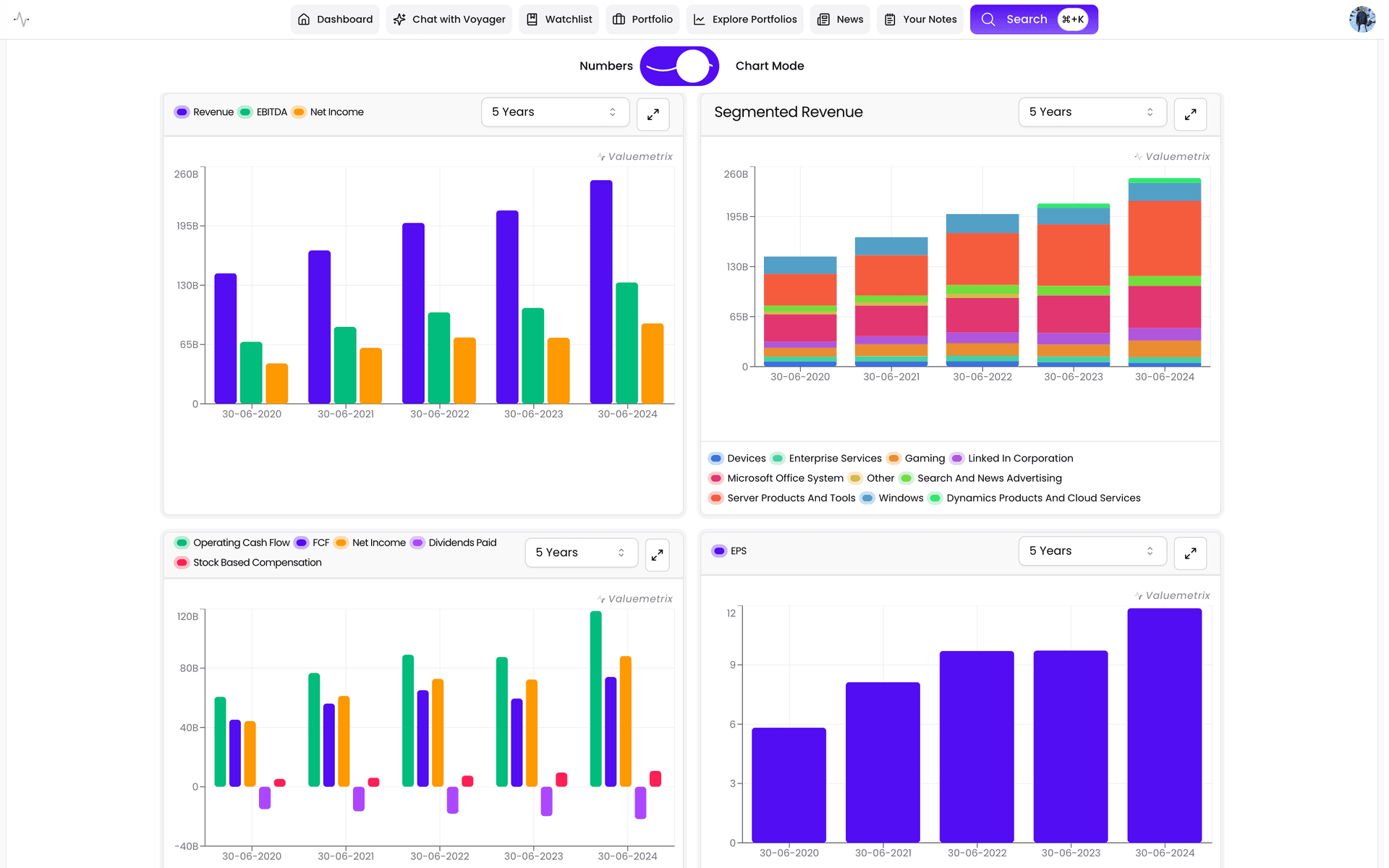

Valuemetrix: Institutional-Grade Analytics for Retail.

Democratizing Wall Street-grade research. We verified that retail investors could handle institutional data density.

About the Project

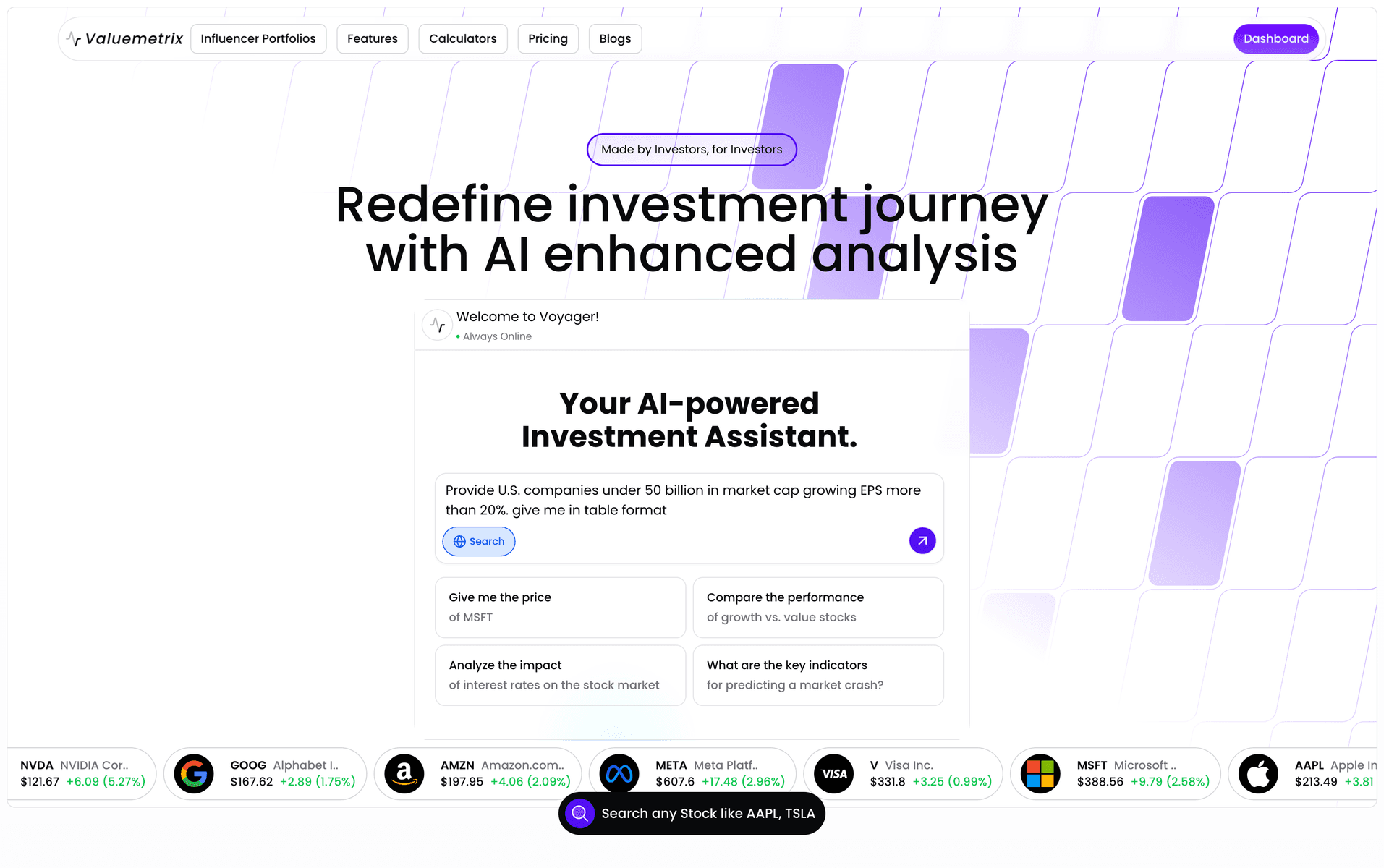

Retail investment tools are usually pretty toys. Valuemetrix is a weapon. We set out to build a platform that gives individual investors the same real-time data density and AI synthesis that hedge funds pay millions for.

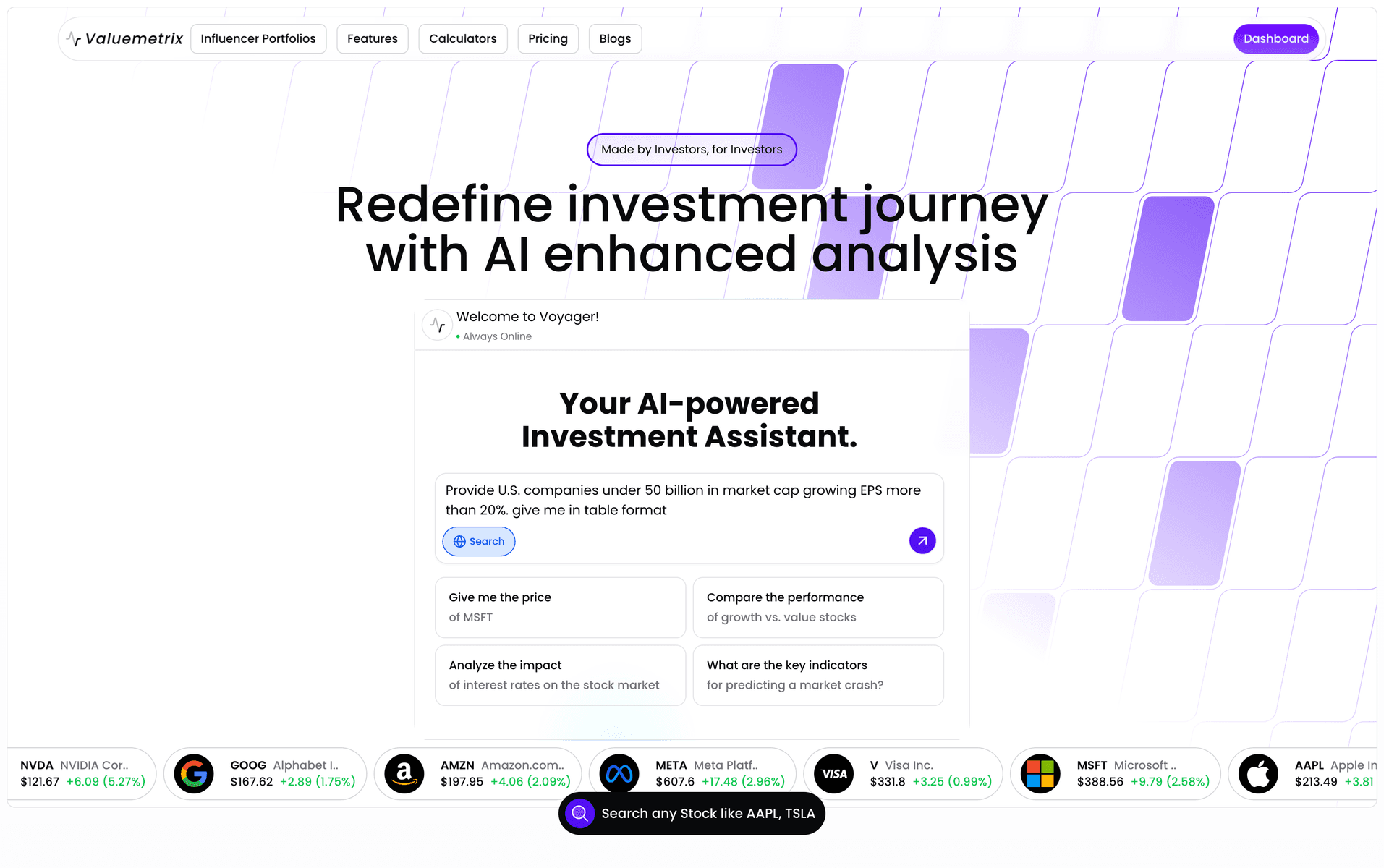

This wasn't just about showing charts; it was about processing massive streams of market data and synthesizing them into actionable 'Buy/Sell' narratives using LLMs. Pixelwand architected the entire data pipeline and frontend visualization layer.

Challenges

Data Velocity: Processing real-time ticks from 32+ exchanges without crashing the browser.

Regulatory Compliance: Ensuring all financial advice and data handling met strict SEC-level security standards.

Cognitive Overload: Presenting complex financial ratios without overwhelming the user.

Solutions

Built a custom RAG (Retrieval-Augmented Generation) pipeline that ingests live SEC filings and earnings calls to generate instant investment memorandums.

Developed a proprietary caching layer using Redis to serve heavy financial queries in <200ms.

Integrated with 32+ brokerage APIs for direct trade execution, removing the friction between analysis and action.

Results

Achieved 1,000+ weekly active users within 3 months.

4-minute average session time (3x industry average).

Acquired due to the proprietary value of the AI research engine.

Future Roadmap

Q3 2026: Mobile-first native app (iOS/Android) for trading on the go.

Q4 2026: Social sentiment analysis integration (Reddit/Twitter firehose).

Frequently Asked Questions

With lots of unique questions, We will be answering most of the Frequently Asked Questions here.